What Is Arbitrage? Forex Glossary

Contents:

Well, according to the Economist, the Purchasing Power Parity for those two currencies is at 106 mark, yet as we can see at the beginning of this chart the pair traded well above 128 level. As we can see from this example, traders can benefit from both scenarios. So this is the essence of Forex covered interest arbitration strategy. This approach aims to exploit the interest rate differentials between the two currencies. For example, nowadays, the Federal Funds rate is confined within the 0 to 0.25% range. Consequently, putting money in the Bank Certificates of deposit might not be the most attractive option for many people.

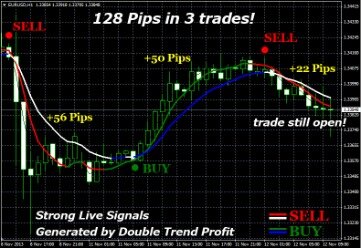

How to Use The Accelerator Oscillator For Forex TradingThe Accelerator Oscillator indicator helps detect different trading values that protect traders from entering bad trades. The Commodity Channel Index is a technical indicator that can identify overbought or oversold levels in market conditions as well as potential trend reversals and trade signals. Access our latest analysis and market news and stay ahead of the markets when it comes to trading. If both of the brokers have a 1.5 pip spread for this pair, the transaction costs would be $300 for this amount, which would leave you with a $609 profit.

What are some of the most undervalued major currencies according to the Purchasing Power Parity measures?

FXCM Markets is not required to hold any financial services license or authorization in St Vincent and the Grenadines to offer its products and services. However, market researchers have found that negative spread situations still do arise in particular circumstances. They can also arise because of price quote errors, failure to update old quotes in the trading system or situations where institutional market participants are seeking to cover their clients’ outstanding positions. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. In case of a positive result, enter trades on a real account with a minimum volume in order to evaluate the impact of the spread and psychology on the result. This strategy is based on the difference in interest rates between the two countries.

Does Crypto Arbitrage Still Work In 2022? – Finance Monthly

Does Crypto Arbitrage Still Work In 2022?.

Posted: Mon, 13 Jun 2022 07:00:00 GMT [source]

Suppose a trader opens a long trade on 10 securities with a current value of $500. Before the merger date, the share price can fluctuate up and down. Traders must conclude a transaction with such a volume that they have enough funds to hold an open position, considering these fluctuations. If the transaction occurs, the trader will exit the trade at $52.5, getting $525 for 10 shares. If the transaction does not occur, the trader must close the position based on the market situation.

Support and resistance indicator: What is, How to use, and Best Strategies

When information about an acquisition becomes public, https://forex-world.net/ traders start buying shares of the company that is being sold, as they expect the price to rise to the share repurchase target. Further, when the target price value is reached, the buying company becomes the counterparty of arbitrage traders. The possibility of a successful transaction is not guaranteed due to blocking by regulatory authorities or due to force majeure. Therefore, arbitrage traders cannot be sure that they will be able to sell the asset at the stated buyout price. The crypto market is highly volatile, so the discrepancies can be more significant than on the stock or currency exchanges. Also, this market is not strictly regulated by law, so people are reluctant to transfer their investments there.

As we have already stated, arbitration does not always have to take the same form. In today’s article, we have written for you 3 ways of arbitration, which we believe are very popular among traders. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. The Commitment of Traders report is a weekly publication that shows the aggregate holdings of different participants in the U.S. futures market.

ZWD/USD: Zimbabwe Dollar Plunges After Warning to State … – Bloomberg

ZWD/USD: Zimbabwe Dollar Plunges After Warning to State ….

Posted: Mon, 09 Jan 2023 08:00:00 GMT [source]

On the other hand, the more Arbitrage forexs you execute, the more money you can potentially earn. Let us take a very simple example to better understand the concept. Let us assume you are interested in sneakers and know which styles are in high demand. Now you see a certain sneaker priced at $500 at one marketplace, and $550 at another. To successfully do arbitrage trading, you would buy the sneaker from marketplace A for $500 and sell it to marketplace B for $550.

We will discuss its history, its background and its context within today’s modern markets. We will also walk through a detailed example of what is called the triangular arbitrage process and speak to the profitability of this form of trading. These Expert Advisors will set custom parameters according to your strategy. This means you can execute orders automatically within your set specifications and not have to manually scour markets for arbitrage trading opportunities. So, a merger arbitrage strategy involves attempting to predict whether a company will be taken over and purchasing the shares – or going long – before the deal is officially announced. In a pure arbitrage play, a trader will find a currency, commodity or stock that is priced differently on two different exchanges.

The definition of the Forex arbitrage states that it is basically a very low-risk method, where traders exploit the pricing inefficiencies in the market, by buying and selling several currency pairs simultaneously. In Forex trading, there are essentially three ways to use the currency arbitrage strategy. Forex arbitrage trading strategy allows you to profit from the difference in currency pair prices offered by different forex brokers. By leveraging price inefficiencies and allowing traders to buy and sell currency pairs that are currently diverging but expected to converge soon. On top of that, there is continuous fluctuation in the exchange rates because of constant demand and supply dynamics.

Forex arbitrage often requires lending or borrowing at near to risk-free rates, which generally are available only at large financial institutions. The cost of funds may limit traders at smaller banks or brokerages. Spreads, as well as trading and margin cost overhead, are additional risk factors. Experienced traders do this at a much larger scale and frequency.

Arbitrage

Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders. One option is to find two crypto exchanges where the price of the same cryptocurrency is different. Next, you buy a cryptocurrency on the exchange where its price is lower, and at the same time sell the same cryptocurrency on another exchange where its price is higher.

Fixed income arbitrage is based on the difference in interest rates between different types of securities, such as stocks and bonds. In classical trading, there is a possibility of both a positive and a negative outcome for each individual trade. In arbitrage trading, the success of a trade depends only on the speed of its conclusion. Thus, the more the current price differs from the buyout one, the greater the potential profit for merger arbitrage.

Launch Software

Brokerage services in your country are provided by the Liteforex LTD Company (regulated by CySEC’s licence №093/08). The technical storage or access that is used exclusively for anonymous statistical purposes. The performance quoted may be before charges, which will reduce illustrated performance. However, recognize that other factors might come into play like seasonal trends and economic data releases which may affect how well you profit from any given trade with what is arbitrage. The time it requires to identify opportunities that are good for you, so what is arbitrage may not suit everyone. An arbitrage can provide a reasonable return on investment, and it’s very low risk compared with other investments.

The buying pressure on the lower-priced asset and the selling pressure on the higher-priced asset on different exchanges causes the prices to converge eventually. Arbitrage in the world of finance refers to a trading strategy that takes advantage of irregularities in a financial market. Forex arbitrage involves identifying and taking advantage of price discrepancies that can arise in the valuation of one or more currency pairs. The general characteristic of real arbitrage is a “risk-free” profit, but achieving this result usually involves taking a certain degree of risk during the execution of the trade. Often, the risk of execution actually exceeds the small profit that arbitrageurs commonly take in.

Understanding Financial Security Goals & Importance of financial understanding to achieve it.

When trading in the spot market, traders place a sell order for the currency pair having a low interest rate and a buy order for the currency pair having a high interest rate. After a while, he swaps the currency positions and sells the one with a higher interest rate, and buys the one with a lower interest rate. Hence, the trader makes a profit from the interest rate difference. One approach which might satisfy the above-mentioned two criteria is the triangular arbitration strategy.

- Arbitrage trading is a strategy that aims to take advantage of market inefficiencies.

- It is also necessary to conduct a study to find instruments, the profitability of which will cover the costs.

- Unfortunately, institutional participants such as high-frequency traders have the inside track on speed.

- The second condition is if the profit from arbitrate trade is greater than the cost of transaction costs.

- Therefore, arbitrage traders cannot be sure that they will be able to sell the asset at the stated buyout price.

To make a profit, an arbitrage trader does not need to come up with a unique trading strategy, it is enough to find a good arbitrage robot and the ability to obtain quotes as quickly as possible. This type of arbitrage trading occurs when one public company acquires another. Under the terms, the acquiring company must buy back the stocks of the target company . The purchase price is usually set above the market price so current shareholders can profit. Forex arbitrage is a risk-free trading strategy with no open currency exposure where two brokers are offering different quotes for the same currency pair. Cross ratesare the exchange rates of 1 currency with other currencies, and those currencies with each other.

Are you trading with candle power?

The average profit of an arbitrage trade is a few pips, so even one pip difference between the planned and actual prices will significantly affect the result. Open a trading account, learn to identify the difference in the price of the same asset and act quickly. The speed of arbitrage transactions is directly proportional to the profitability of this type of trading. Traders will also make a profit, albeit smaller, in case of convergence of profitability indicators by any amount.

In other words, the greatest difficulty with this is having to buy and sell across all the brokers instantly. The broker’s prices may be off because they are based on different data feeds, liquidity providers, or due to a host of other reasons. In this article, you are going to uncover what is arbitrage and how they are used for trading opportunities. You started with $500,000, and you now have $502,550 after a few simple trades. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

Determine significant support and resistance levels with the help of pivot points. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Trading Station, MetaTrader 4 and ZuluTrader are four of the forex industry leaders in market connectivity. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. EUR purchase on the London Stock Exchange at a lower price and simultaneous EUR sale on the New York Stock Exchange at a higher price if the volume of both transactions is the same.

Crypto arbitrage survived the market turmoil, but few are able to … – TechCentral

Crypto arbitrage survived the market turmoil, but few are able to ….

Posted: Fri, 21 Oct 2022 07:00:00 GMT [source]

During the types of manual arbitrage that are not demanding on speed, the deposit can be commensurate with standard trading. Choose a market, considering the type of transactions and the number of commissions. In the case of automated trading, take into account the costs of hardware and/or software. Statistical arbitrage is based on the principle of price reversion to the average value. A short trade is opened for overbought shares, and a long trade is opened for undervalued shares. During the intra-industry arbitrage, price divergences are tracked between various highly correlated assets.