venture capital advantages and disadvantages: Advantages and disadvantages of Startup Business loans Business loans, Start up business, Start up

Contents:

It is one of the main reasons many companies do not want to issue share capital because they lost one part of ownership. This is because each share represents some value to the company; if someone holds the majority of it, they can even remove the company’s owner from the leader position. With the help of shares, capital companies can raise money whenever they need to without worrying about interest or extra expenses.

Venture capital firms are sometimes structured as partnerships, the final partners of which serve as the managers of the agency and can serve as investment advisors to the enterprise capital funds raised. Venture capital corporations within the United States may also be structured as restricted legal responsibility firms, during which case the firm’s managers are often known as managing members. Venture capitalists typically work for venture capital businesses that raise money from external investors, unlike angel investors who invest their own money. High net-worth individuals, large corporates, and investment firms like pension funds and insurance companies might be included in this group of investors, referred to as limited partners.

What You Need To Know About Venture Capital Funding

In such cases, the young entrepreneurs depend on venture capitalists, seed funding and bank loans for procuring funds. Investors, after assessment of the business prospects, invest their money in start ups, small and medium sized business or enterprises that tend to have long-term growth. This capital is known as venture capital and the investors are known as venture capitalists. Some buyers put money into startup businesses hoping that these firms will become the next business leaders; these investors are referred to as venture capitalists.

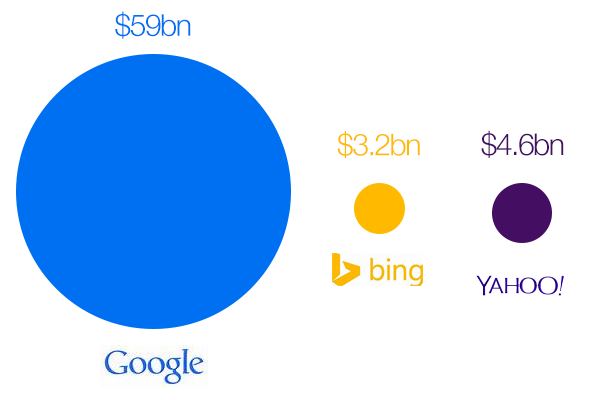

https://1investing.in/ Capital is the most suitable option for funding a costly capital source for companies and most for businesses having large up-front capital requirements which have no other cheap alternatives. Software and other intellectual property are generally the most common cases whose value is unproven. That is why; Venture capital funding is most widespread in the fast-growing technology and biotechnology fields. First-stage funding is money given to businesses that need money to get started.

DISADVANTAGES

Furthermore, most Indian VC funds take minimum investments of INR 1 crore, but some funds take a minimum of INR 3 crore or more. Management or leveraged buyout funding is given to businesses to help them buy another business or product. Acquisition funding this type of funding helps companies acquire specific areas/ expertise of other businesses.

Thus, the following infographic states how in general an established Venture Capitalist spends their time. Supporting portfolio companies– Supporting these companies with various activities like marketing, fundraising and various financial as well as administrative issues, etc. Further, the majority of the investments are observed to be at the Seed/ Early stage. This is a “getting slowly rich” kind of a job wherein advancing up the ladder is over the decades.

What Is Venture Capital and its Functions, Objective, Features and Advantages

It is also different from that of an ordinary stock market investor who merely trades in the shares of a company without participating in their management. India is fast catching up with the West within the area of venture capital and a number of enterprise capital funds have a presence in the nation . In 2006, the whole amount of private fairness and enterprise capital in India reached $7.5 billion throughout 299 offers. It can be used to refer to investors “providing seed”, “begin-up and first-stage financing”, or financing companies which have demonstrated extraordinary enterprise potential.

They understand the dynamics of how these institutions work and can make introductions for you to increase your chances of getting funding. Second, if an entrepreneur has a really good idea but lacks the funds to get it started, VC investment can be a good option. If you do decide to pursue venture capital funding, here are a few things you need to know before you start looking for investors. When you acquire venture capital funding, what you are getting is “smart money”. This implies that the money you receive comes with the added benefit of the venture capital firm’s expertise. To get your company on the proper track to growth and success, you’ll frequently collaborate with firm partners, other startup owners who have received capital, and specialists from both of their networks.

- Venture capital investors want to see your company raise additional financing at a better valuation.

- Ideally, the time allocation for an established VC varies from that who has just started.

- For startups and early-stage businesses attempting to develop new products or technology today, venture capital is a crucial source of investment.

- While its impact varies by region, the venture capital business is crucial in encouraging entrepreneurship and innovation.

- #TypeDefinition1Seed fundingAs the same suggests, seed funding or seed capital is the capital invested to help entrepreneur conduct initial activities for setting up a company.

It usually covers the hiring of extra key venture capital advantages and disadvantages, conducting additional market research, and finalizing the product or service before launching it into the market. Pepperfry.com, India’s largest furniture e-marketplace, has raised USD100 million in a fresh round of funding led by Goldman Sachs and Zodius Technology Fund. Pepperfry will use the fundsto expand its footprint in Tier III and Tier IV cities by adding to its growing fleet of delivery vehicles. It will also open new distribution centres and expand its carpenter and assembly service network. This is the largest quantum of investmentraised by a sector focused e-commerce player in India.

Cost Of Financing Is Expensive

The allocation of venture capital will result in the company’s quick expansion. There are numerous varieties of venture capital, and each has advantages and disadvantages of its own. Seed funding, angel investing, and venture loans are the three most popular forms of venture capital.

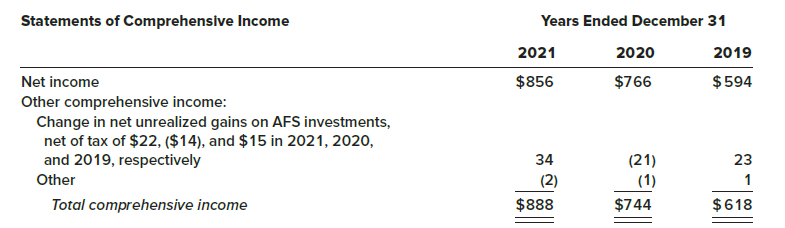

If a company goes public with an IPO or is acquired by another company, investors may receive a large return on their investment. Venture Capital advantages and disadvantages, like any other startup funding choices, should be weighed before funding. In exchange for equity, venture capitalists provide funds to fast-growing businesses. It contributes significantly to the life cycle of developing businesses by investing in high-risk, growth-oriented projects. The purpose of this research paper is to analyse the development and growth of venture capital funds in India. The venture capital industry in India has been in operation in some form since 1973.

The concept of venture capital can be traced back to the post-World War II period when the government-funded small businesses to stimulate economic growth. In the 1950s and 1960s, venture capital firms began to emerge as a way for high-net-worth individuals to invest in small businesses. In concluding the blog we summarize capital investment as a decision made by the company as a long-term growth strategy. Although the beginning minimums and initial investment fees for alternative assets might be considerable, transaction costs are frequently lower than those for traditional assets due to reduced turnover.

OpenSea vs Blur vs Rare NFT Marketplace: Which is best? – CryptoSaurus

OpenSea vs Blur vs Rare NFT Marketplace: Which is best?.

Posted: Thu, 02 Mar 2023 07:03:27 GMT [source]

Venture capital finance is often thought of as ‘the early stage financing of new and young enterprises seeking to grow rapidly. Long Term Investment – Venture capital financing is a long-term investment. It generally takes a long period to encase the investment in securities made by the venture capitalists. The typical venture capital investment occurs after an initial “seed funding” round. The first round of institutional venture capital to fund progress is called the Series A round. Nevertheless, PricewaterhouseCoopers’ MoneyTree Survey exhibits that complete venture capital investments held regular at 2003 ranges via the second quarter of 2005.

Venture capital financing has become a part of the popular business in India. These Investments are growing at an exponential rate and one who is starting his business can look it as a good option of financing its venture. Venture Capital Funds are classified on the basis of their utilisation at different stages of a business. The 3 main types are early stage financing , expansion financing , and acquisition/buyout financing.

But the greatest reason to enter this industry is extreme passion about being a part of creative innovative ideas that have a potential to disrupt the pattern. Further capital which was invested to continue the business in the absence of profit is known as second round financing. The capital which was invested during the running of the business enterprises is known as Start Up. The capital which was invested to start a new business is called Seed Capital. 1.It provides finance as well as skill to the entrepreneurs and enterprise.

Problems arise frequently as a result of faster expansion, and they must be addressed on an urgent basis before they spiral out of control. A venture capital firm will invest in your company in exchange for equity in the company. This implies that, unlike small businesses and personal loans, your company will not be required to make monthly payments.

The venture capital fund then seeks out private equity investments that have the potential to generate positive returns for its investors. This procedure entails the fund’s manager analyzing hundreds of business proposals in search of possibly high-growth enterprises. Venture Capital investments are early-stage capital, seed capital, or expansion-stage financing, depending on how old the business is and when the investment is made. In a growing industry, startups frequently find themselves as one of the few rivals. Traditional bankers are unlikely to lend to such businesses venture capital firms would. This money can help startups grow and try to capture a substantial portion of a growing market.